Legal Heirs as per Hindu Succession Act

Succession in the case of a Hindu Male dying intestate

In an earlier article on Wills we have seen what happens if a person dies intestate i.e. without making a Will. In such a situation, the person’s assets and properties get distributed as per the personal law or The Indian Succession Act. If a person belonging to the Hindu, Sikh, Jain or Buddhist community dies without making a Will, the Hindu Succession Act applies. In case of Muslims dying without making a Will, the personal succession law applies. In case of any persons other than above dying without making a Will, the Indian Succession Act applies.

The Hindu Succession Act lay down a specific formula as per which the assets and properties are to be distributed if an Indian Hindu dies without making a Will.

The purpose of this article is only to give a basic idea about how the law applies. Readers are requested to consult an Estate Planner or lawyer for their individual situations.

The Hindu Succession Act, as mentioned earlier applies to Hindus, Sikhs, Jains and Buddhists. It applies to legitimate and illegitimate children and to converts and reconverts to this religion.

When a Hindu male dies without making a Will, the heirs would fall under the following categories, in that order.

(1) Class I Heirs

(2) Class II Heirs

(3) Agnates

(4) Cognates and

(5) Government

(1) Relatives

belonging to Class I (see chart below) will first be eligible for the deceased

Hindu male’s assets and properties. These are

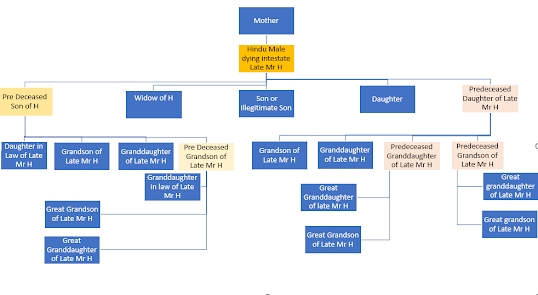

Pictorially this can be depicted as follows.

Even a single member of Class I would have claim over a group of members from Class II.

(2) If there are no heirs as mentioned in Class I, the heirs mentioned in Class II would be eligible for the intestate deceased Hindu Male’s assets and properties. These are

Pictorially this can be depicted as follows.

(3) If there are no members belonging to either Class I and Class II the properties and assets of a Hindu male dying intestate would devolve on a group of relatives who are classified as Agnates. Agnates are relatives (male or female) who trace their relationship with one another either through blood or by adoption through the male lineage. A person for instance is an agnate of his father’s brother’s son. Similarly father’s brother’s widow is also an agnate. What is important to note is that the relationship should be because of a male lineage.

(4) If there are no members or relatives in either the Class I or Class II or the Agnates category, the assets would devolve on Cognates. Cognates are persons (male or female) who trace their relationship with one another either by blood or adoption not wholly through a male lineage. A person for instance is a cognate of his father’s sister’s son. Similarly one’s brother’s daughter’s son would become one’s cognate. What is important to note is that whenever a relationship with a female intervenes in the line, one becomes a cognate of another.

Even amongst Agnates and Cognates the order of succession is determined as per rules laid down.

(5) If any of the above four categories of relatives are not available, the properties and assets of a Hindu male dying intestate would belong to the Government.

The hierarchy mentioned above is to be followed :

Class I heirs,

Class II heirs,

Agnates,

Cognates and

finally

Government.

Sounds very technical. Better to get such things done by an experienced professional

ReplyDelete