Today, Sunday, February 11, 2024, as I was going through the newspaper in the morning, I saw a pamphlet. A local financial advisor had arranged for it to be inserted in the local newspapers. The pamphlet invited the reader to a 'FREE FINANCIAL HEALTH CHECKUP,' providing details about the time, venue, and additional information regarding the Financial Health Checkup that the advisor proposed to provide.

As I looked at this colorful pamphlet, the subject for this blog sprung to my mind - The Importance of Regular Financial Check-Ups

A regular financial health checkup can ensure one’s financial well-being which is crucial for a stable and stress-free life. Just like we prioritize our physical health with regular check-ups, our financial health also requires periodic examinations. In this article let us explore the significance of regular financial check-ups and how they contribute to a secure and prosperous future.

Understanding Financial Health

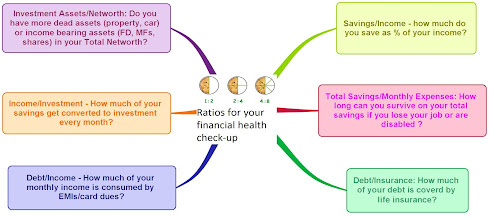

Regular financial check-ups serve as a diagnostic tool for individuals to comprehend their current financial situations. By assessing their income, expenses, savings, and investments, they gain a clearer picture of their overall financial health. This awareness becomes the first step towards making informed decisions to improve their financial well-being.

Budgeting for Success

One of the key aspects of a financial check-up is revisiting and, if necessary, adjusting their budget. A budget acts as a roadmap for their finances, helping them allocate funds wisely, prioritize expenses, and avoid unnecessary debt. Regular check-ups ensure that their budget remains realistic and adaptable to life changes.

Identifying and Reducing Debt

Debt can be a significant burden on one’s financial health. Through regular financial check-ups, individuals can identify areas where debt may be accumulating and take proactive steps to reduce it. Whether it's credit card debt, loans, or mortgages, a timely check-up allows them to create a plan to tackle and manage their debts effectively.

Saving for the Future

Savings play a crucial role in achieving financial goals and providing a safety net for unexpected expenses. Regular financial check-ups provide an opportunity for individuals to evaluate their savings strategy. Are they saving enough? Are their savings invested wisely? Adjusting one’s savings plan based on their current financial situation ensures they're on track to meet their short-term and long-term goals.

Investment Portfolio Optimization

For those with investments, a financial check-up is an ideal time to review and optimize their portfolio. Market conditions and personal goals may change, influencing the performance of their investments. By regularly assessing and adjusting their investment strategy, they can maximize returns and minimize risks.

Emergency Preparedness

Life is unpredictable, and unexpected events can have a significant impact on their finances. Regular financial check-ups help individuals assess their emergency fund. Is it sufficient to cover unforeseen expenses? By ensuring their emergency fund is adequate, they provide themselves with a financial safety net in times of need.

Insurance Coverage Evaluation

Insurance is a vital component of financial planning, providing protection against various risks. During a financial check-up, it's essential for individuals to review their insurance coverage. Are they adequately covered for health, property, and life? Adjusting insurance policies based on changes in their life circumstances ensures that they are adequately protected.

Retirement Planning

Planning for retirement is a long-term financial goal that requires periodic evaluation. Regular financial check-ups allow individuals to assess their retirement savings, adjust contributions, and make informed decisions about their retirement investments. This proactive approach ensures a comfortable and secure retirement.

Financial Education and Awareness

Engaging in regular financial check-ups promotes financial literacy and awareness. It encourages individuals to stay informed about economic trends, investment options, and personal finance strategies. This knowledge empowers individuals to make sound financial decisions and navigate the ever-changing financial landscape effectively.

Building Financial Discipline

Consistency is key when it comes to financial well-being. Regular financial check-ups foster financial discipline by encouraging individuals to stick to their budgets, savings plans, and investment strategies. The habit of regularly assessing and adjusting one's financial plan contributes to long-term financial success.

To sum up, regular financial check-ups are a crucial component of maintaining a healthy and robust financial life. Just as individuals prioritize routine health check-ups, dedicating time to assess and optimize their finances ensures that they are on the path to financial well-being. By understanding their financial health, budgeting wisely, managing debt, and planning for the future, they pave the way for a secure and prosperous financial future. Regular financial check-ups are not just a task; they are an investment in their financial well-being and peace of mind.

The content made available in this article is for general informational purposes only. While every effort has been made to ensure the accuracy and completeness of the content, it should not be considered as a substitute for professional consultation.

No comments:

Post a Comment